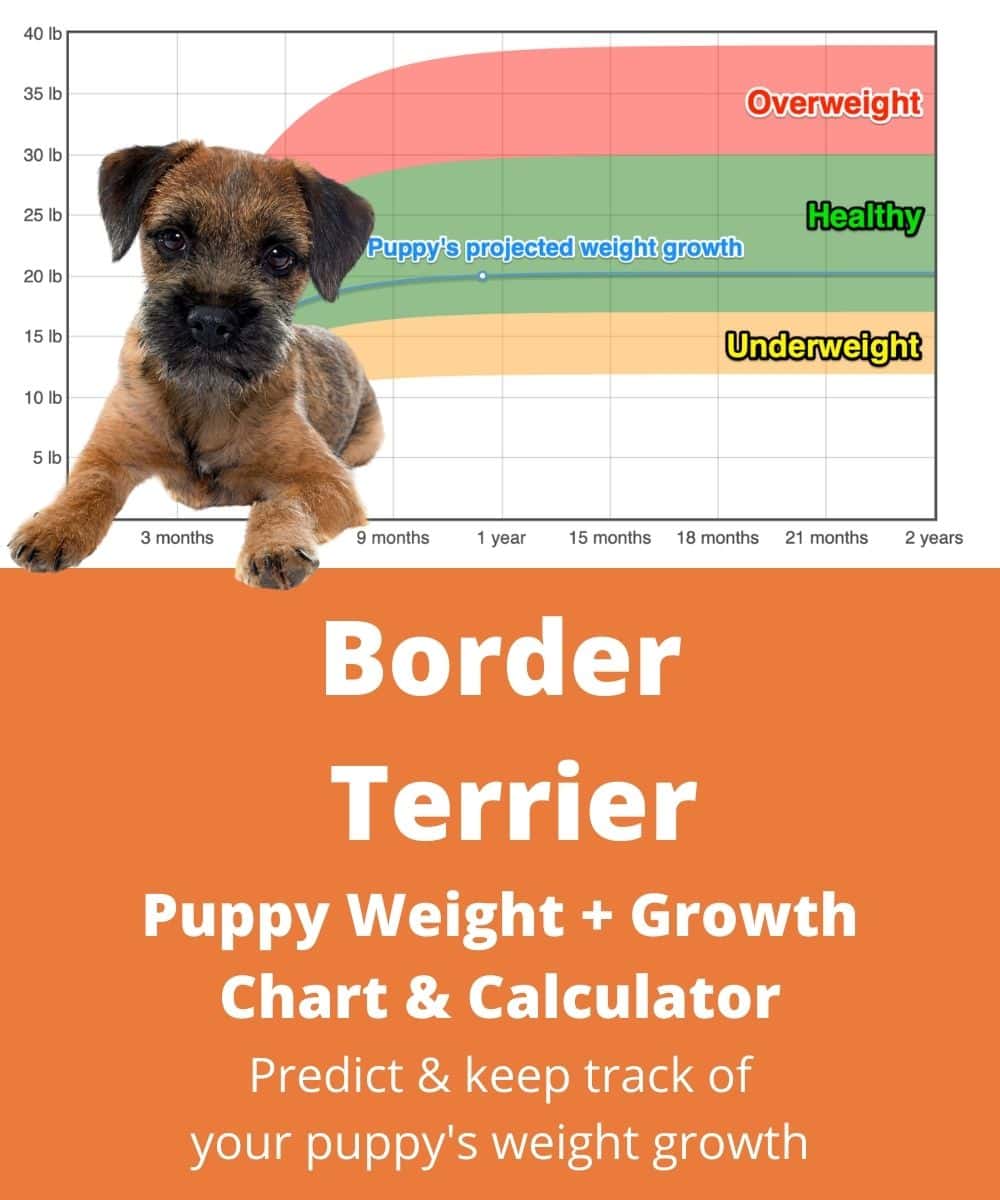

How big will your Border Terrier puppy grow into?

Estimate the adult weight of your Border Terrier puppy in 5 simple steps using our free puppy weight chart!Protect your beloved pets without breaking the bank

- Unlimited video calls & texts with vets

- Available 24/7

- Annual $3,000 emergency fund

- LIMITED TIME - 7 DAYS FREE trial

- SPECIAL OFFER - 20% OFF 1st month

Code: GOODY20

- Flexible coverage

- Hassle free claims

- Multiple pets family plan

Quiz Time!

Cryptocurrency DOs And DON'Ts – Tips For First-Time Investors

Chanting “YOLO, to the moon!” is all fun and games until you find yourself in the red because you made unwise investments in the heat of the moment. Unfortunately, the reality when it comes to investing in volatile markets like cryptocurrency is that more people fail than those who succeed.

The good news is that you can avoid this with the right mindset and strategies.

If you are a rookie in the crypto investment space, here are 8 dos and don'ts that will help you avoid the most common investment pitfalls while increasing your chances of actually “making it to the moon”.

But before we get into the tips, it is important that we make the disclaimer that there is no way to guarantee absolute success with investment. You just have to make wise decisions and hope for the best. Here are a few of these wise decisions.

DO your due diligence to understand the coin and the market

Unfortunately, there is a lot of misinformation out there about the cryptocurrency market. It is important that you do your own research from as many credible sources as possible.

This will help you understand not only the crypto market but also whichever cryptocurrency you are specifically interested in.

DON'T give in to hype or FOMO

In a market as volatile as the cryptocurrency market, it is very easy to give into the hype and follow the masses when it comes to making investments.

Don't do it.

This brings us to our first point. Do your research and only make your investment when you fully understand what you are getting yourself into.

DO diversify your portfolio

It is never a good idea to put all your eggs in one basket when it comes to investments and cryptocurrency is not an exception.

While going all in means massive wins if your chosen cryptocurrency thrives, it also means massive losses if things go south.

Instead of going all in on one currency, spread out your risk across different cryptocurrencies. Better yet, consider diversifying your investment portfolio by including other markets like stock, commodities, and forex.

DON'T knock the old coins until you try them

New coins may be all fun and shiny but they are usually more unpredictable than the old coin. It is never too late to hop onto older coins that have a track record, use cases and have been around for years. The likes of Bitcoin and Ethereum may be a bit pricier to invest in but they are usually more predictable as they have been around and analyzed for much longer.

DO figure out your trading style

Are you a bear or a bull? Are you in it for short-term gains or are you playing the long game?

As with any investment opportunity, it is important to pick a trading style and plan your strategies around it when working with cryptocurrency.

DON'T get into the market as it dips

There is this misconception that cryptocurrencies that experience dips will inevitably raise. This is not always the case which is why you may want to wait before investing a crypto that is on a downward trend.

Again, doing your research helps as you will be able to figure out whether it is a dying currency or one that is taking a dip before an exponential rise.

DON'T panic or trade reactively

The cryptocurrency market is way too volatile for you to afford to be reactive. Never make any trade moves out of excitement or panic. Remember the goals and strategies that you set based on your trading style and stick with those.

This will help you avoid making emotional decisions that may end up costing you dearly.

DO only invest what you are ready to lose

Unfortunately, loses are inevitable when it comes to any investment for even the most seasoned of crypto traders. The trick is minimizing the impact of your hits in which case it is important to only invest what you are ready to lose.

That way, if things go sideways, you are not left completely penniless and at square zero. By investing a little at a time, you will always have capital to start over with in case of loses that would have otherwise been devastating.